The relentless hum of the digital gold rush continues, even as 2025 looms large on the horizon. Cryptocurrencies, once relegated to the fringes of finance, are now firmly entrenched in the global landscape. Bitcoin, the undisputed king, maintains its dominance, while Ethereum pushes the boundaries of decentralized applications, and a playful upstart like Dogecoin captures the internet’s collective imagination. This vibrant ecosystem fuels a constant demand for mining hardware, but the question echoing through the server rooms is: how long will this equipment last, and how can we squeeze every last drop of value from it?

Understanding the lifespan of used mining hardware is crucial, especially for those deeply invested in mining operations or considering entering the fray. We’re not just talking about the physical degradation of silicon; we’re talking about economic viability in a rapidly evolving technological landscape. A mining rig purchased today might seem powerful, but in a year or two, newer, more efficient models could render it obsolete, consuming more power for less profit. This isn’t a death sentence for your investment, but it necessitates a strategic approach to maximizing its lifespan and value.

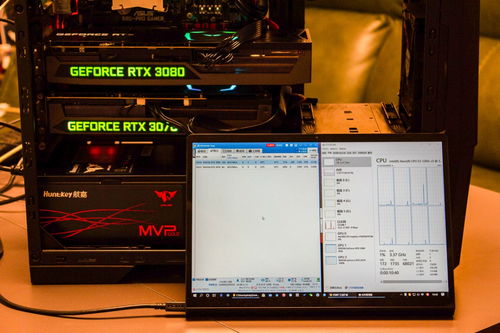

Factors influencing the lifespan of mining hardware are multifaceted. First, there’s the hardware itself: the Application-Specific Integrated Circuits (ASICs) that are the workhorses of Bitcoin mining, and the powerful GPUs used for Ethereum and other algorithm-based currencies. These components are designed for intense, continuous operation, often running at 100% utilization for months or even years. Heat, a byproduct of this constant activity, is a major enemy, degrading components over time. Proper cooling solutions – from basic fans to sophisticated immersion cooling systems – are paramount to extending hardware life.

Beyond the hardware, the cryptocurrency market itself plays a significant role. The difficulty of mining a particular coin – a metric that reflects the computational power required to solve a block and earn a reward – is constantly adjusted. As more miners join the network, difficulty increases, requiring more powerful hardware to remain competitive. This necessitates upgrades and often relegates older hardware to less profitable cryptocurrencies or alternative uses.

The rise of sophisticated mining farms, often located in regions with cheap electricity, further complicates the equation. These large-scale operations benefit from economies of scale, allowing them to invest in the latest hardware and advanced cooling systems. Smaller miners using older equipment struggle to compete, highlighting the growing gap between industrial and individual mining endeavors.

So, how can miners maximize the value of their used hardware in 2025? Several strategies exist. First, meticulous maintenance is essential. Regularly cleaning dust, replacing thermal paste, and monitoring temperature are crucial. Second, consider overclocking – carefully increasing the clock speed of the hardware to boost performance. This can provide a temporary boost, but it also increases heat and can shorten lifespan if not done cautiously. Third, explore alternative uses for older hardware. Even if it’s no longer profitable to mine Bitcoin, it might still be viable for mining other, less competitive cryptocurrencies. Alternatively, GPUs can be repurposed for machine learning, gaming, or even sold to consumers.

Another option is mining machine hosting. Companies that offer this service provide the infrastructure, including electricity, cooling, and maintenance, allowing miners to focus on maximizing their hash rate. While there are costs associated with hosting, it can be a cost-effective way to keep older hardware running and generating revenue.

Finally, consider the resale market. Used mining hardware can still fetch a reasonable price, particularly in regions where electricity costs are lower or among hobbyist miners. Platforms specializing in used mining equipment can connect buyers and sellers, providing a viable exit strategy for older hardware.

The future of cryptocurrency mining is uncertain, but one thing is clear: adaptability is key. By understanding the factors that influence hardware lifespan, implementing proactive maintenance strategies, and exploring alternative uses and resale options, miners can maximize the value of their investments and thrive in the ever-evolving digital landscape. The hum of the machines may change, but the pursuit of digital gold continues.

Exploring innovative strategies, this article delves into extending used mining hardware lifespan through advanced maintenance, market trends, and energy efficiency, offering unexpected insights to maximize value and sustainability in 2025’s evolving digital landscape.