The financial landscape is perpetually shifting, a volatile dance between established norms and disruptive innovations. In this dynamic arena, cryptocurrencies have emerged as a formidable force, challenging the very foundations of traditional investment strategies. But navigating the complexities of the digital asset world requires more than just speculative enthusiasm; it demands a sophisticated understanding of the underlying technology and infrastructure. And at the heart of that infrastructure lies mining.

For years, traditional investments have centered around stocks, bonds, real estate, and commodities. These assets, while offering varying degrees of stability and returns, are often subject to market fluctuations influenced by geopolitical events, economic policies, and investor sentiment. Cryptocurrencies, particularly Bitcoin (BTC), present an alternative paradigm. Their decentralized nature, scarcity, and potential for appreciation have attracted a diverse range of investors seeking diversification and higher yields.

However, simply purchasing and holding cryptocurrencies is only one facet of the digital asset investment landscape. Mining, the process of verifying and adding new transactions to the blockchain, represents a more active and potentially lucrative avenue for participation. But building and maintaining a profitable mining operation requires significant capital investment, technical expertise, and access to reliable and cost-effective energy sources.

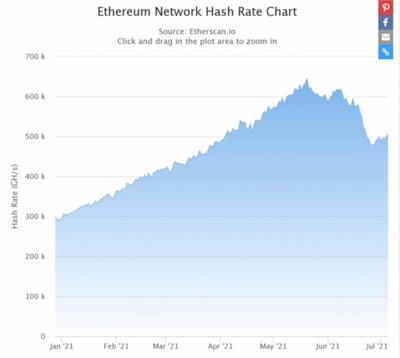

This is where advanced mining solutions come into play. Companies specializing in mining machine sales and hosting services are transforming the way individuals and institutions approach cryptocurrency mining. By offering state-of-the-art mining rigs, optimized for specific algorithms and energy efficiency, they lower the barrier to entry for aspiring miners. Furthermore, hosting services provide secure and climate-controlled environments for these machines, along with technical support and maintenance, relieving investors of the burden of managing complex hardware and infrastructure. For example, an investor might choose to mine Dogecoin (DOG), leveraging ASICs designed for the Scrypt algorithm, or focus on Ethereum (ETH) mining, taking advantage of GPUs before the full transition to Proof-of-Stake.

The benefits of leveraging advanced mining solutions are manifold. Firstly, they democratize access to mining, enabling individuals and smaller institutions to compete with larger players in the market. Secondly, they optimize efficiency, reducing energy consumption and maximizing profitability. Thirdly, they mitigate risk by providing secure and reliable infrastructure, minimizing downtime and protecting against potential hardware failures. This is especially crucial in the highly competitive world of Bitcoin mining, where efficiency and uptime are paramount.

The cryptocurrency market is not without its challenges. Volatility, regulatory uncertainty, and the evolving technological landscape all pose potential risks to investors. However, advanced mining solutions can help mitigate these risks by providing access to the latest technologies, optimizing operational efficiency, and offering expert guidance on navigating the complexities of the mining ecosystem. The use of specialized ASICs for Bitcoin mining, for instance, requires constant monitoring and upgrades to remain competitive.

Moreover, the environmental impact of cryptocurrency mining has become a growing concern. As such, many mining operations are increasingly focusing on renewable energy sources, such as solar, wind, and hydroelectric power, to reduce their carbon footprint. Mining farms are increasingly located in regions with abundant renewable energy, further minimizing their environmental impact and attracting environmentally conscious investors.

The future of cryptocurrency mining is likely to be characterized by increased sophistication, automation, and sustainability. Advanced mining solutions will continue to play a crucial role in this evolution, enabling investors to participate in the growth of the digital asset market while minimizing risk and maximizing returns. As more institutions and individuals recognize the potential of cryptocurrency mining, the demand for these solutions is poised to surge, further transforming the traditional investment landscape.

In conclusion, transforming traditional investments with advanced mining solutions offers a compelling opportunity for investors seeking to diversify their portfolios and capitalize on the burgeoning digital asset market. By leveraging state-of-the-art mining machines, optimized hosting services, and a commitment to sustainability, investors can navigate the complexities of cryptocurrency mining and unlock its immense potential. The future is digital, and mining is the engine that powers it.

This article explores how cutting-edge mining technologies are revolutionizing traditional investment landscapes, blending innovation with resource extraction to unlock new financial opportunities and sustainability, challenging conventional paradigms in unexpected and multifaceted ways.